Insurance Result For The Current Fiscal Year 2024/2025

Owners, we do have positive result on the insurance front, remember or budget for the current fiscal year is $905,935.00, on a cash basis way of reporting our result. The actual cost is $825,996.00 meaning a surplus in the insurance account #310 of $79,939.00.

This insurance surplus in accordance with the appropriate resolution adopted, will be transferred to account #2535 “INSURANCE DEDUCTIBLE RESERVE”. By doing so we are not using insurance favorable result for other expenses or investments. We do need those funds to compensate for the current inflation trend and Waterside from specialist analysis we were already in a recuperation mode. So, this result is good news.

Internally we have done estimate for future year budget. Rule changed at the State level, there is more to do. They had on the agenda the last legislative session an item to force the insurance company to declare internal funds transfer between subsidiaries or parent company, in addition they were planning to force companies to divulgate renumeration of senior officers, both did not make the cut during the last legislation.

It is a long road ahead, our broker was not in a position at this time to provide trend for May 2026, remember that our budget for year 2025-2026 is due by September 2025, hope to be able to come up with more development before that time.

The first column on the chart refer to the various coverage, from buildings, wind, general liability, director and officer (inclusive of volunteers), crime and the umbrella policy. The second one is the carrier that provide the coverage. You can notice the changes from one year to the next, like for the hurricane we still have Citizens, for the property ex-wind we are now with WKF&C. All our carriers have a “A” rating, so they will be able to pay claim, our insurance broker does not deal with “B” type of insurance company.

The third column is the amount of coverage for each of the policy. The two following columns refer to cost for the fiscal year 2022/2023 and 2023/2024. Then you have the projected percentage increase for the budget year 2024/2025, then the forecasted budget by the different insurance policies, the actual cost by policies for the current budget year on a cash out basis and the last column is the increase or reduction in % for each policy. The total increase year over year is $1,357 and a negligible % increase.

Thanks for reading, if you have any questions, please do not hesitate to send an email to the office or via our new website.

Andre Mongrain

President, May 5, 2025

Related Post

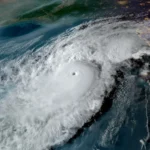

NOAA predicts above-normal 2025 Atlantic hurricane season

2025-04 Monthly Financials

Electrical car charging stations and solar energy opportunities

New Website for 2025 and Some History!

2025-03 Monthly Financials

Condo Rules & Regulations

On this page you will find all the rules and regulations at Waterside Village of Palm Beach, inc.